We’ve got a new sand mine application, River Valley Sands, and their filing includes a copy of the lease deal that they’ve signed with the slickster mine promoter. So we can take a look at a real deal and see how good it is. Click HERE for a copy of the application document if you want to read along. I’ll be talking about the first lease, the one with Deland and Patricia Powers (which starts on page 27 of the application document), but more fun can be had by reading them all if you want.

A couple disclaimers. I’m not a lawyer, I don’t even play one on TV, so this isn’t legal advice. I’m just a guy that’s signed a lot of deals, and these points are like the ones I would write up for my lawyer to go research if I were presented with a stinker like this one. I’m also biased. I don’t like what these outsider promoters are doing to our County, the residents like me who are going to have to put up with the impacts of these mines for decades, or the farmers that they’re screwing with these deals.

The price is lousy — $1/ton. Can’t say this for sure, but if you look at all the “whited out” royalty-payment sections of these leases, a buck a ton is the only one that seems to fit. That’s on the low end of the prices we’ve heard. But that’s not the worst of it…

There’s no adjustment for inflation. Which means that 10 or 20 or 50 years from now the promoter, or whoever they transfer this lease to (see below) will still only have to pay a buck a ton. What does that mean? Let’s use historical inflation rates (click HERE for the calculator I used) and see.

First the 20-year scenario. $1/ton in 1990 would fetch $1.65/ton in 2010 if they had an inflation clause in their contract. Putting it the other way, the $1/ton they’ll get paid today will only be equivalent to $.59/ton in 20 years if the inflation rate matches the period from 1990 to 2010.

But wait, there’s more! Since these leases run forever (see below), let’s try those numbers in 50 years. $1/ton in 1960 would fetch $7.28/ton in 2010 if this contract had included an adjustment for inflation — doing it the other way, $1/ton in 1960 is the same as $.14/ton today.

The monthly draw. I don’t think the monthly advance these people are getting is very big. The language in the Royalty section is pretty weird and the white-outs don’t help. But here’s the way i figure it — and arrive at the princely sum of $500/month.

The lease has this completely weird sentence in there that says “meaning that additional monthly payments to the farmer will begin to accrue once the promoter hauls 500 tons from the premises.” Now, that language is a bit ambiguous — but i think they mean 500 tons in a month (since they’re talking about a monthly payments), which means the draw is $500/month if the price is $1/ton. That’s the only way I can make sense out of that part of the deal. A guarantee of $500/month is a far cry from the $1million/year that land-owners have been telling us they’re going to get. That’s so far away that we need to ask another question.

What happens if there are excess monthly draw payments and things go bad? Let’s go another way with this. Suppose that my interpretation of that paragraph is way off and the monthly draw is something more interesting — let’s say $10k/month.

The land owner starts drawing $120k/year against future sand. 10 years pass — the land owner has drawn $1.2million — not too bad! Suppose the promoter goes broke, or just decides not to renew the lease. Let’s also assume that the promoter didn’t pull 1.2million tons of sand out of the mine over that 10 years. Now the farmer has been paid for more sand than has been removed.

The question I’d have asked my lawyer is “what happens?” Does the land owner have to pay those excess dollars back? My guess is “probably,” since the word “draw” usually is talking about some form of a loan against future performance. There’s no language in here that describes what happens when there is more draw than sand, so if I were in this deal I’d be keeping those excess payments in a rainy-day fund and not spending them.

The promoter can assign this lease to somebody else. We’ve been saying for a long time that the people doing these deals are really putting them together so that they can sell the package to somebody else, make a quick killing and walk away. So of course this contract has language that lets them do that. The land owner has absolutely no say over when that happens, who the buyer is, nothing. And the land owners certainly don’t get paid anything when that happens.

The promoter can renew this lease forever. The lease comes up for renewal every 10 years and there’s no limit on the number of times it gets renewed before it gets renegotiated. So all those royalty payment rates? They’re forever as well.

The promoter can renew this lease for free. There’s a payment that’s been made at the beginning of this lease. But there aren’t any payments when the lease renews. So why would they ever let the lease expire, ever? It’s free to keep rolling it over. Oh, did I mention that there’s no requirement for the promoter to take out a minimum amount of sand per year? So the promoter could just keep this lease in their pocket (or sell it to somebody else) for a couple decades and fire this thing up when market conditions are right. Good luck trying to sell this land with a lease like that.

Would a buyer of this land see any benefit from the lease? I don’t see any corresponding mechanism for the transfer of the lease for the land owner. Suppose they want to sell their land (and the promoter doesn’t bite on the one-sided right of first refusal deal)? Does the new buyer become a party to the lease? Presumably they’re stuck with the obligations, but do they get any of the money? How is the value of the lease calculated into the sale price of the land? Makes my head hurt.

As I said at the top — I’m a biased guy and not a lawyer. But this deal doesn’t look all that good to me from the land-owner’s point of view. Pretty good for the promoter though.

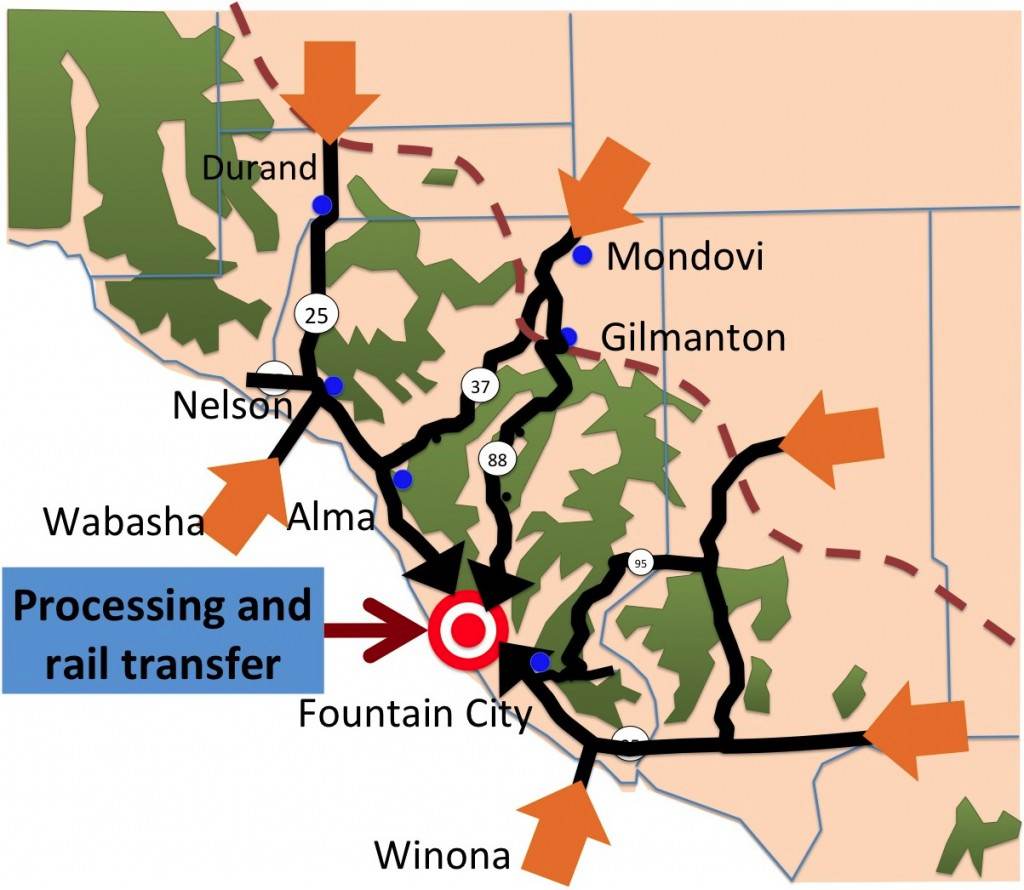

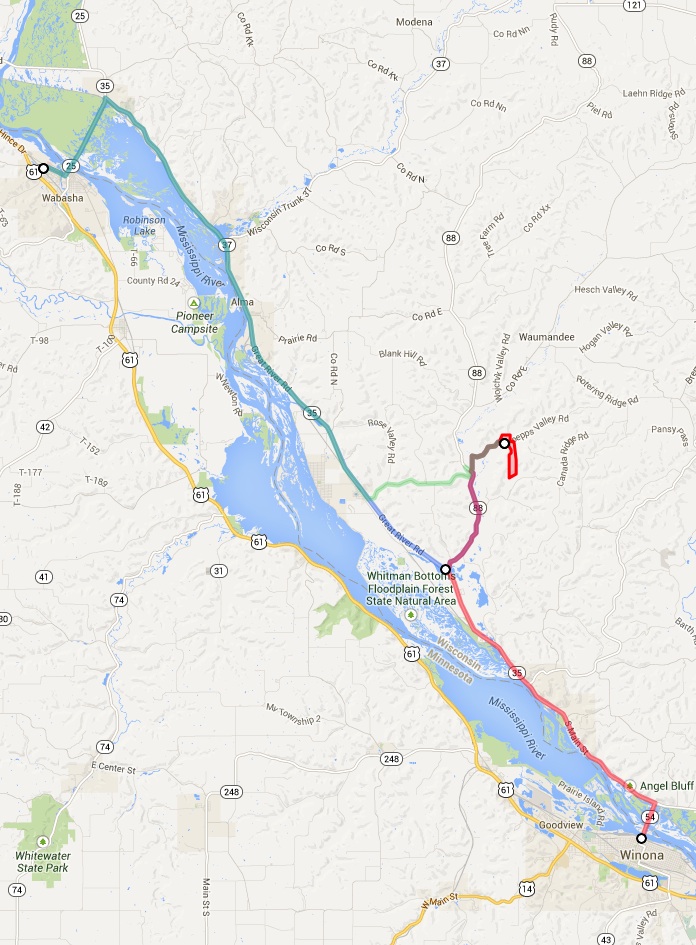

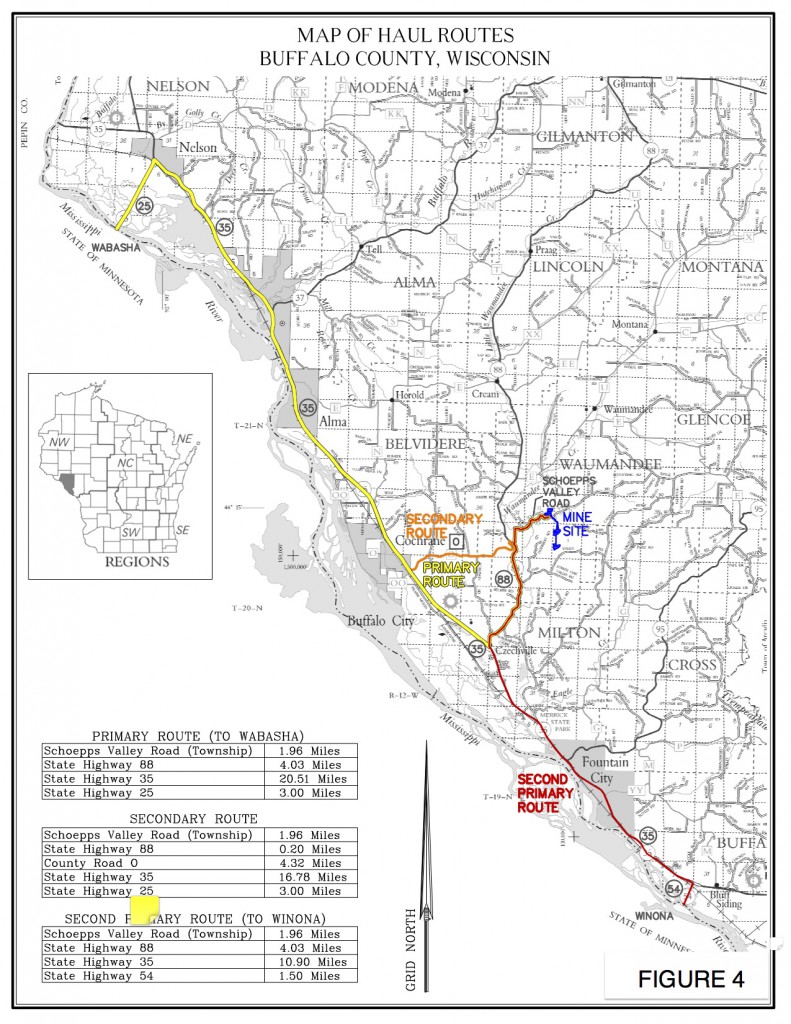

We’ve mentioned this before. Frac sand is all about rail. If your mine is right on a railroad spur, transportation costs are lower. A lot lower. Now there’s a credible article that puts a number on how much lower.

We’ve mentioned this before. Frac sand is all about rail. If your mine is right on a railroad spur, transportation costs are lower. A lot lower. Now there’s a credible article that puts a number on how much lower.